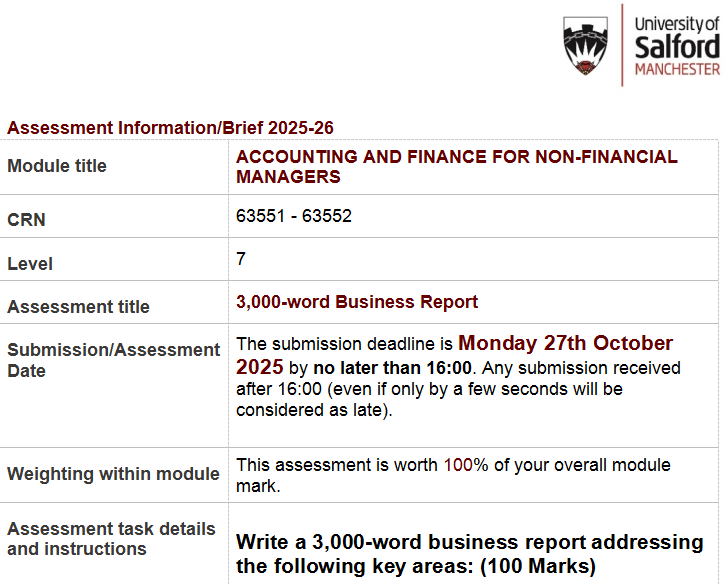

CRN 63551 – 63552 Accounting and Finance for Non-Finance Managers Level 7 Assessment Brief 2025/26

Assessment task details and instructions

Write a 3,000-word business report addressing the following key areas: (100 Marks)

Scenario Context:

You are acting as a financial advisor for a fictional medium-sized company, RetailEdge Ltd, operating in the UK retail sector. The company manages a nationwide chain of lifestyle and consumer goods stores and is seeking strategic guidance to enhance its financial performance, adopt emerging digital tools, and ensure compliance with ethical and legal obligations. You are required to prepare a 3,000-word business report presenting your financial insights, strategic evaluation, and professional recommendations.

This report should be structured as a cohesive, evidence-based document integrating the following key areas:

1.The Strategic Role of Accounting and Finance

Critically evaluate how accounting and finance support strategic decision-making and the achievement of organisational objectives, using real-1-world examples where possible. Position your discussion within the context of RetailEdge Ltd and the retail sector.

2-Financial Data Analysis

Analyse the financial statements (Below) provided for RetailEdge Ltd over three years. Apply appropriate financial techniques (e.g. ratio analysis and trend analysis) to assess the company’s financial performance. Interpret the results and provide specific, actionable recommendations for improvement.

3-Digital Trends in Finance

Evaluate key digital finance trends relevant to the retail industry. Discuss the potential of technologies such as data analytics, AI, or blockchain to support strategic financial decision-making for RetailEdge Ltd.

4-Ethical and Legal Compliance

Discuss the importance of ethical behaviour and legal compliance in financial reporting. Use relevant corporate case studies or examples to demonstrate the consequences of non-compliance. Propose strategies that RetailEdge Ltd can adopt to maintain integrity and comply with regulations.

5-Executive Summary and Conclusion

Provide a concise executive summary capturing key insights and strategic recommendations from your analysis. Summarise the importance of the integrated financial and strategic insights for the company’s long-term success.

Provided Dataset:

Financial Statements

Fictional data for a medium-sized company

Statement of Profit or Loss

|

|

Year 1 (£) |

Year 2 (£) |

Year 3 (£) |

|

Revenue |

2,200,000 |

2,750,000 |

2,900,000 |

|

Cost of Sales |

(1,300,000) |

(1,600,000) |

(1,650,000) |

|

Gross Profit |

900,000 |

1,150,000 |

1,250,000 |

|

Administrative Expenses |

(420,000) |

(500,000) |

(480,000) |

|

Depreciation & Amortisation |

(50,000) |

(55,000) |

(70,000) |

|

Operating Profit |

430,000 |

595,000 |

700,000 |

|

Finance Costs |

(30,000) |

(32,000) |

(45,000) |

|

Profit Before Tax |

400,000 |

563,000 |

655,000 |

|

Taxation |

(80,000) |

(120,000) |

(140,000) |

|

Profit for the Year |

320,000 |

443,000 |

515,000 |

Statement of Financial Position

|

|

Year 1 (£) |

Year 2 (£) |

Year 3 (£) |

|

Property, Plant & Equipment |

1,200,000 |

1,400,000 |

1,550,000 |

|

Intangible Assets |

100,000 |

130,000 |

160,000 |

|

Total Non-current Assets |

1,300,000 |

1,530,000 |

1,710,000 |

|

Inventory |

700,000 |

800,000 |

780,000 |

|

Trade Receivables |

500,000 |

650,000 |

600,000 |

|

Cash and Cash Equivalents |

300,000 |

340,000 |

420,000 |

|

Total Current Assets |

1,500,000 |

1,790,000 |

1,800,000 |

|

Total Assets |

2,800,000 |

3,320,000 |

3,510,000 |

|

Share Capital |

800,000 |

900,000 |

1,000,000 |

|

Retained Earnings |

500,000 |

670,000 |

850,000 |

|

Total Equity |

1,300,000 |

1,570,000 |

1,850,000 |

|

Long-term Borrowings |

800,000 |

850,000 |

950,000 |

|

Trade Payables |

700,000 |

900,000 |

710,000 |

|

Total Liabilities |

1,500,000 |

1,750,000 |

1,660,000 |

|

Total Equity and Liabilities |

2,800,000 |

3,320,000 |

3,510,000 |

Submission Instructions

- Word Count: 3,000 words (±10%, excluding references, tables, and appendices).

- Formatting: Use standard business report structure with a title page, executive summary, main body, conclusion, and reference list.

Using Generative Artificial Intelligence (GenAI) tools

|

Word count/ duration (if applicable)

|

Word Count: 3,000 words (±10%, excluding references, tables, and appendices). Formatting: Use standard business report structure with a title page, executive summary, main body, conclusion, and reference list. |

|

How to submit |

For coursework assessments only: students with a Reasonable Adjustment Plan (RAP) or Carer Support Plan should check your plan to see if an extension to this submission date has been agreed. You should submit your assessment via Turnitin on Blackboard. As the University will mark assessments anonymously where possible, include your student roll number and not your name on your assessment. Do not upload links in the submission area, as we cannot access them and therefore cannot mark your work. If you have saved your files on your University of Salford OneDrive, dragging files to the submission area may attach a link instead of the file. Always attach files using the paperclip icon. |

|

Feedback

|

You can expect to receive feedback within 3 weeks (15 working days) post submission. Details will be on Blackboard. |

Assessment Criteria:

The report will be graded based on the following criteria:

1. Knowledge and Understanding (30%)

- Depth of understanding of the strategic role of accounting and finance in organizations.

- Demonstration of critical awareness of digital trends, ethical compliance, and financial decision-making.

2. Application of Theory (30%)

- Effective application of accounting and financial analysis techniques to the provided dataset.

- Relevance and practicality of recommendations.

3. Research and Evidence (20%)

- Use of appropriate and credible academic and industry sources to support arguments.

- Integration of case studies or real-world examples.

4. Structure, and Clarity (10%)

- Logical structure, clear organization of content, and adherence to the word count.

- Professional presentation, including proper formatting, use of headings, conclusion, and tables/graphs where relevant.

5. Referencing and Academic Integrity (10%)

- Correct use of referencing style (e.g., Harvard or APA).

- Inclusion of a reference list with high-quality sources.

The standard university descriptors of performance will be used in giving feedback.

At level 7 the pass mark is 50% and the scale is:

|

Percentage Mark |

Level of Performance |

|

90 – 100 |

Outstanding |

|

80 – 89 |

Excellent |

|

70 – 79 |

Very Good |

|

60 – 69 |

Good |

|

50 – 59 |

Satisfactory |

|

40 – 49 |

Needs Improvement |

|

30 – 39 |

Needs Significant Revision |

|

0 – 29 |

Needs Substantial Work |

Assessed intended learning outcomes

On successful completion of this assessment, you will be able to:

1.To explore the strategic role and scope of accounting and finance in organisations.

2.To examine key approaches to accounting and financial analyses and how such analyses can be interpreted to support

3.management decision making.

4.To review key trends in the digital environment of finance and their implications for organisations.

5.To examine the need for legal compliance and ethical conduct in the reporting of financial performance

Intended Learning Outcomes:

- Demonstrate a critical appreciation of the role and scope of accounting and finance in organisations.

- Explain how key approaches to accounting and financial analyses can be used to inform and support management decision making.

- Demonstrate a critical awareness of key trends in the digital environment of finance and their implications for organisations.

- Demonstrate a critical awareness of the need for legal compliance and ethical conduct in the reporting of financial performance.

- Interpret select accounting and financial data to

- inform management decision making.

- Effectively use digital and non-digital means to develop and communicate clear and concise insights, conclusions and recommendations.