ECON3300 Agricultural Economics & Marketing Assignment 2 Question | UWA

ECON3300 QUESTION 1. Understanding futures and options contracts

- What is the main difference between futures and options contracts in terms of downside risk? How does one of these contracts help mitigate that risk?

- Suppose a wheat producer takes a short position in the futures market as a hedge. Would this position benefit from an increase in the basis? Explain your reasoning.

ECON3300 Question 2a: Short hedge (Weaker Price Weaker Basis)

Assume you are a wheat producer in Western Australia with a crop to be harvested in November. Today is May 3, 2025 and the January 2026 Eastern Australia Wheat (WM) futures contract is trading at 6365/ton on the ASX You expect to sell 6000 tons of wheat, and the size of each futures contract is 20 tons. The forecasted basis for late January 2026 is S45/ton.

What is your expected forward price?

Assume the hedge is lifted (offset) on SJanuary 2026, when the January Eastern Australia Wheat (WM) futures contract is trading at 5340/ton, and the actual basis is S5/ton weaker than expected (under). The brokerage fee is S5 per contract per transaction (equivalent to S0.25 per ton per transaction).

Complete the T-Bar Diagram to compute the Actual Sale Price:

c)Did the actual sale price equal the expected sale price? Explain why or why not.

Are You Looking for Answer of ECON3300 Assignment 1

Order Non Plagiarized Assignment

ECON3300 Question 2b: Short hedge (Stronger Price Stronger Basis)

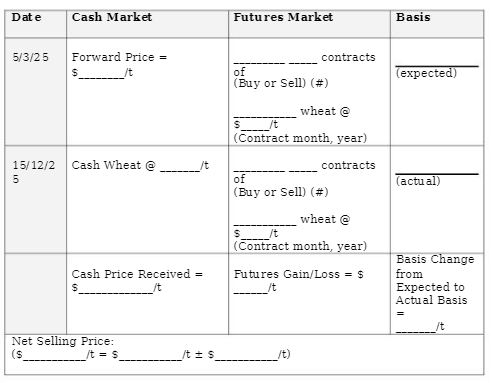

Assume the hedge is lifted (offset) on 15 December 2025, instead of 5 January 2026, when the cash market price for wheat in Geraldton is $470/tonand the actual basis is $20/tonstronger than expected. The brokerage fee is still $5 per contract per transaction (equivalent to $0.25 per ton per transaction).

Complete the T-Bar Diagram to compute the Actual Sale Price:

c) Did the actual sale price equal the expected sale price? Explain why or why not.

ECON3300 Question 2c: Short hedge (Weaker Price Stronger Basis)

Assume the hedge is lifted (offset) on 10 January 2026, instead of 5 January 2026, when the January Eastern Australia Wheat (WK) futures contract is trading at $320/ton, and the actual basis is $15/tonstronger than expected. The brokerage fee is still $5 per contract per transaction (equivalent to $0.25 per ton per transaction).

Complete the T-Bar Diagram to compute the Actual Sale Price:

c) Did the actual sale price equal the expected sale price? Explain why or why not.

Buy Answer of ECON3300 Assignment 1& Raise Your Grades

Request To By Answer

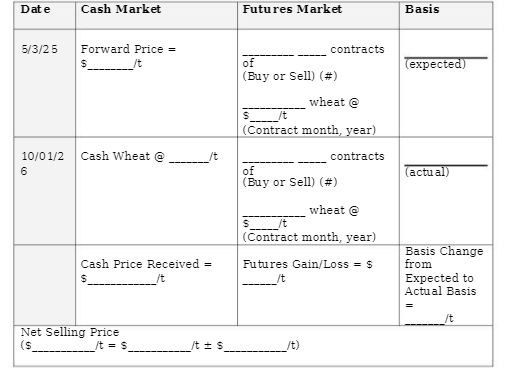

ECON3300 Question 3. Long Hedge

Consider the case of a Flour Milling Company (FMCO) in Western Australia, that is planning to purchase wheat in December 2025 to meet production targets. Today is 3/3/2023 and the January 2026 Eastern Australia Wheat futures contract is trading at 5370 per metric ton. The expected basis is S 10 per metric ton and the brokerage fee is S0.25 per metric ton per transaction.

ECON3300 Question 4. Option Contracts

Use the attached futures and options data from ASX to answer the following questions. Assume the historical expected basis is $30 under per tonand the brokerage fee is $0.25 per metric ton per transaction.

4.1 A short hedger

- wheat producer in Western Australia) purchases $430 put option. a)What is the floor price(i.e., the minimum price the producer will receive) with the option in place?

- What is the intrinsic valueand the time valueof the purchased put option? c)Is the put option in-the-money, at-the-money, or out-of-the- money?

4.2 A wheat processor in Western Australia (a hedger) purchases a call option with a strike price of $500.

- What is the ceiling price(i.e., the maximum price the processor will pay) with the call option in place?

- What is the intrinsic value and the time value of the purchased call option?

- Is the call option currently in-the-money, at-the-money, or out-of- the-money?